gia8767786146

About gia8767786146

The Best Gold and Silver IRA: A Complete Guide To Precious Metals Investment

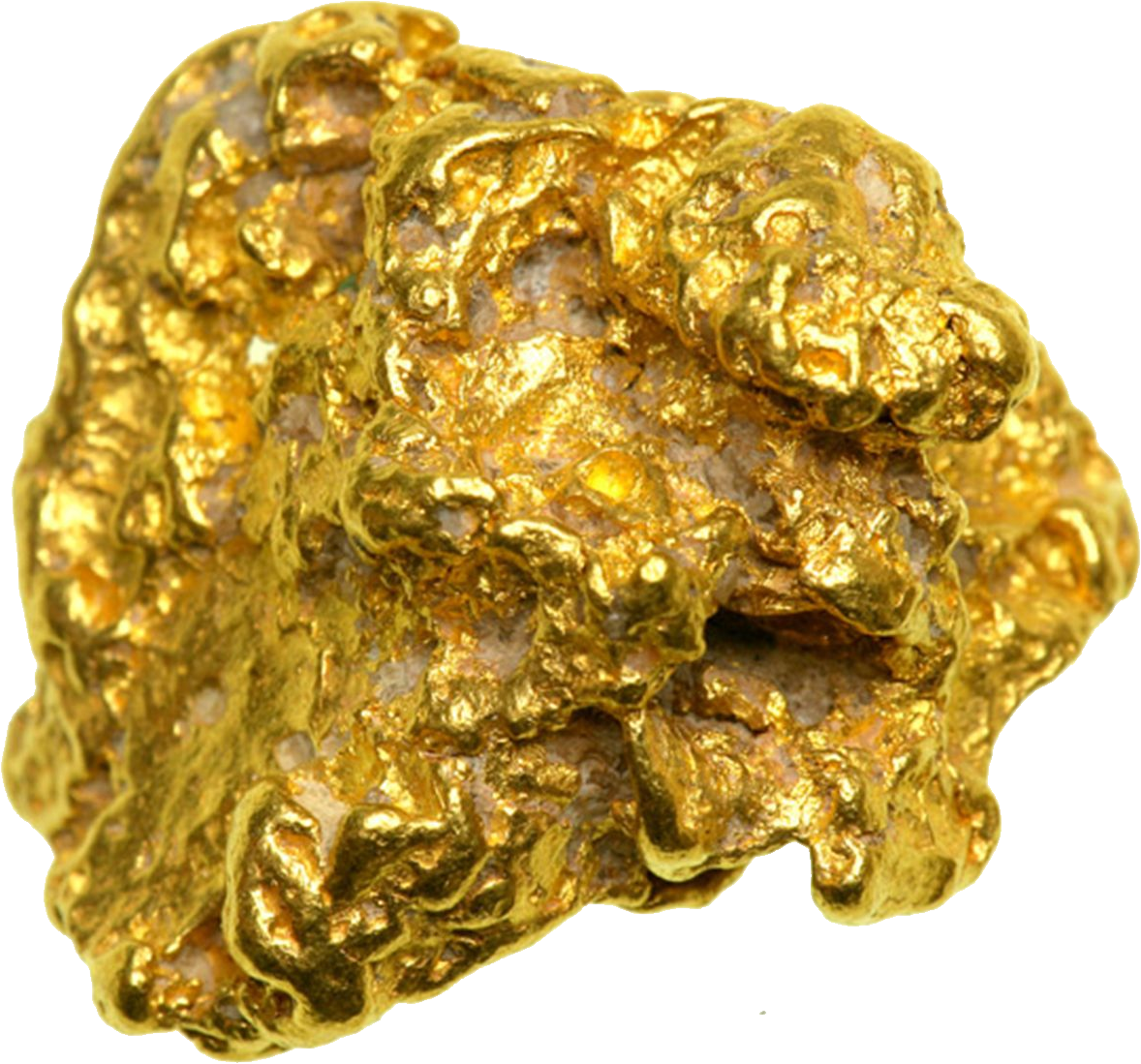

In an ever-altering economic panorama, investors are more and more searching for methods to diversify their portfolios and safeguard their wealth. Considered one of the most effective methods for attaining this is through Gold and Silver Particular person Retirement Accounts (IRAs). These specialised accounts allow individuals to put money into valuable metals, offering a hedge towards inflation and market volatility. In this text, we will discover the best gold and silver IRA options out there, the advantages of investing in valuable metals, and key concerns for potential investors.

Understanding Gold and Silver IRAs

A Gold and Silver IRA is a self-directed retirement account that enables traders to hold bodily gold and silver bullion, coins, and different accepted precious metals. Not like traditional IRAs, which sometimes consist of stocks, bonds, and mutual funds, a precious metals IRA enables individuals to diversify their retirement savings with tangible assets. This can be particularly appealing during instances of economic uncertainty, as gold and silver have traditionally maintained their worth.

Benefits of Investing in Gold and Silver IRAs

- Inflation Hedge: Precious metals have long been considered as a safe haven during inflationary intervals. Not like paper currency, which might lose value on account of inflation, gold and silver have a tendency to appreciate over time, preserving buying power.

- Market Volatility Protection: Gold and silver typically have an inverse relationship with the stock market. When equities decline, valuable metals might rise, offering a buffer towards market downturns.

- Tangible Assets: Investing in physical gold and silver permits people to personal tangible property that they will hold of their arms. This could provide peace of mind, especially during times of financial instability.

- Tax Benefits: Gold and Silver IRAs provide tax-deferred growth, which means that traders don’t pay taxes on gains until they withdraw funds in retirement. Additionally, certified distributions may be taxed at a lower charge than unusual earnings.

Choosing the Best Gold and Silver IRA

When selecting the best Gold and Silver IRA provider, traders ought to consider a number of components, including fees, customer support, and the range of out there products. Here are a few of the highest firms to think about:

- Birch Gold Group: Birch Gold Group is understood for its distinctive customer support and instructional sources. They provide a wide choice of gold and silver products, together with coins and bars, and provide personalized steerage throughout the funding course of.

- Noble Gold Investments: Noble Gold specializes in serving to shoppers invest in precious metals for retirement. In case you loved this informative article and you would love to receive details relating to trusted gold ira accounts assure visit our web site. They offer a transparent fee structure and quite a lot of gold and silver merchandise. Their commitment to customer schooling and satisfaction makes them a strong contender out there.

- Advantage Gold: Benefit Gold is praised for its comprehensive academic assets and user-pleasant platform. They offer a various vary of treasured metals and provide personalized assist to assist investors make informed choices.

- Goldco: Goldco has constructed a stable fame for its customer service and expertise in valuable metals. They offer numerous gold and silver products and provide a wealth of instructional supplies, making them a wonderful choice for each new and skilled traders.

- American Hartford Gold: American Hartford Gold focuses on transparency and customer satisfaction. They provide a wide range of gold and silver merchandise and are committed to helping clients obtain their retirement goals by valuable metals investing.

Key Issues for Buyers

Whereas investing in a Gold and Silver IRA could be a smart determination, there are a number of components to keep in mind:

- Storage Necessities: Physical gold and silver should be stored in an authorized depository to satisfy IRS regulations. Buyers ought to inquire about the storage options provided by their chosen IRA custodian and any associated fees.

- Charges and Bills: Totally different IRA suppliers have various payment constructions, including setup charges, storage fees, and transaction charges. It is important to understand the overall prices concerned in sustaining a Gold and Silver IRA to make an knowledgeable decision.

- Investment Choices: Not all gold and silver products are eligible for IRA investment. Buyers should be sure that the coins or bars they wish to purchase meet IRS requirements for purity and authenticity.

- Market Analysis: The prices of gold and silver can fluctuate based on market conditions. Traders should stay knowledgeable about market trends and financial indicators that will influence the worth of their investments.

- Lengthy-Time period Perspective: Treasured metals needs to be viewed as an extended-term funding. Whereas they can provide quick-time period beneficial properties, their true value is realized over time as a hedge towards inflation and market instability.

Conclusion

Investing in a Gold and Silver IRA may be an effective technique for diversifying a retirement portfolio and protecting wealth towards financial uncertainties. By selecting a reputable IRA supplier and understanding the benefits and considerations of precious metals investing, people can position themselves for lengthy-term financial stability. As always, it is advisable to seek the advice of with a monetary advisor before making significant investment decisions, making certain that your decisions align with your general retirement objectives.

No listing found.